Economic Development.

Economic Development.

The Economic Development staff are here to connect you with resources and programs to expand or locate your business in the City of Elkhart. The Economic Development Department is responsible for the administration of several economic development incentives and programs, including:

-

Tax Phase-ins for real and personal property

-

Providing support letters for Riverfront Development District licenses

-

Small business loan funds through the Aurora Capital Development Corporation (ACDC)

-

Providing staff support for the Economic Development Corporation

The Economic Development staff are here to connect you with resources and programs to expand or locate your business in the City of Elkhart. The Economic Development Department is responsible for the administration of several economic development incentives and programs, including:

-

Tax Phase-ins for real and personal property

-

Providing support letters for Riverfront Development District licenses

-

Small business loan funds through the Aurora Capital Development Corporation (ACDC)

-

Providing staff support for the Economic Development Corporation

Notifications.

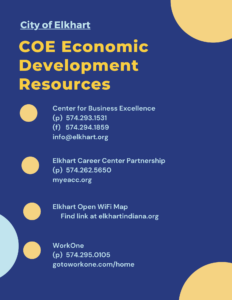

COE Economic Development Resources

News that you can use!

Elkhart Open WiFi Map @ https://www.google.com/maps/d/viewer?mid=1HID0PkP0GfkYyl9TboIoG8XiHDICK7I&usp=sharing

Small Business Awards up to $25,000.00

Apply TODAY!

No longer accepting applications

City of Elkhart We THRIVE!

Coming Soon

Recent News.

Notifications.

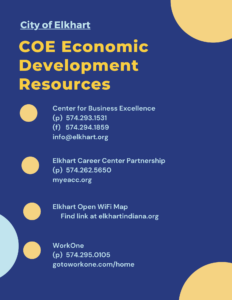

COE Economic Development Resources

News that you can use!

Elkhart Open WiFi Map @ https://www.google.com/maps/d/viewer?mid=1HID0PkP0GfkYyl9TboIoG8XiHDICK7I&usp=sharing

Small Business Awards up to $25,000.00

Apply TODAY!

No longer accepting applications

City of Elkhart We THRIVE!

Coming Soon

Recent News.

Elkhart

Urban Enterprise Assoc.

.

574 294-5471 x 1027

.

About.

.

.

.

The Elkhart Urban Enterprise Association (EUEA) oversees the Elkhart Urban Enterprise Zone (EUEZ) and its programs that address the two-fold mission of the EUEA:

-

Increase the number of jobs in the EUEZ by the retention and expansion of existing businesses, and the attraction and development of new businesses.

-

Improve the quality of life of Zone residents, improve Zone residents’ employability and fill Zone jobs with Zone residents.

The Elkhart Urban Enterprise Zone (EUEZ) is an area of the community that is targeted for physical revitalization, job creation and improvements in social and economic conditions. The designated area includes downtown Elkhart and its nearby neighborhoods, as well as the residential and industrial areas located on the southwest portion of the community.

.

The EUEA Board & Officers

.

James Gardner, President

Therese Geise, Vice President

Bill Lavery, Treasurer

Kevin Bullard, City Council Representative

Arvis Dawson, Zone Resident Representative

Kristin Smole, Economic Development

.

The EUEA Staff

.

Sherry Weber, Clerical Services

Tax

Tax

Incentives.

.

.

The Elkhart Urban Enterprise Association (EUEA) oversees the Enterprise Zone, an area of the urban community targeted for physical revitalization, job creation, and improvements in social and economic conditions. In Elkhart, the Enterprise Zone includes the downtown and its surrounding neighborhoods, as well as its southwest residential and industrial areas.

Property Tax Investments

This refers to the increased value of an Enterprise Zone business property due to

real and/or personal property investment. The added valuation may be deducted for

up to 10 years. Qualified investments include: purchase of an existing building,

repair/rehab/modernization of an existing building, construction of a new building,

onsite infrastructure improvements, purchase of new manufacturing or production

equipment, or retooling of existing equipment.

Investment Cost Credit

Purchasers of ownership interest in a business located in the Zone may be

eligible for credit against their state tax liability. The allowable credit percentage —

of up to 30% — depends on the type of investment, the type of business and the

number of jobs created. This credit may be applied against individual or

corporate Adjusted Gross Income Tax liability. The Indiana Economic

Development Corporation determines the qualification and the credit percentage

allowed — prior to the purchase.

Employment Expense Credit

Enterprise Zone employers can earn tax credits for employing Zone residents. The

credit is the lesser of 10% of the increase in wages paid to qualified employees or

$1,500 multiplied by the number of those employees. The credit may be applied

against Individual or Adjusted Gross Income Tax, Financial Institutions Tax or

Insurance Premiums Tax liabilities.

Lenders associated with the Enterprise Zone may be eligible for loan interest credit. An individual or business that pays taxes in Indiana is entitled to a tax credit on interest income earned from a loan that directly benefits an Enterprise Zone business, increases Enterprise Zone property values or is used to rehab/repair/improve a Zone residence. The credit is equal to 5% of the loan interest received during the year. This credit may be applied against the individual or corporate Adjusted Gross Income Tax, Financial Institutions Tax or the Insurance Premiums Tax. Note: To receive those tax incentives, the lender need not to be located in the Enterprise Zone.

Residents who both live and work in Elkhart’s Enterprise Zone (EZ) may also benefit from potential tax-savings. They are qualified if they live in the EZ, they work at least 50% of the time within the EZ and at least 90% of their services as an EZ employee are directly related to the facility where they work within the EZ. If eligible, they may deduct half of their adjusted gross income earned during the year, up to a maximum deduction of $7,500. This could result in an annual tax savings for each resident of up to $255 if they are qualified and if their earnings within the EZ equal or exceed $15,000.

Indiana

Tax Forms.

.

.

Business

Property Tax Investment Deduction: Form EZ-2 (Indiana State Form 52501). To qualify for the Investment Cost Credit and prior to purchase of a property, a taxpayer must request the Indiana Economic Development Corporation determine whether a purchase of ownership in a business located in an Enterprise Zone is a qualified investment and the credit percentage to be allowed.

Employment Expense Credit : Schedule EZ 1, 2, 3 (Indiana State Form 49178)

Lenders

Loan Interest Credit: Schedule LIC (Indiana State Form 21926)

Employees

Enterprise Zone Qualified Employee Deduction: Schedule IT-40QEC (Indiana State Form 21928)

To learn more or to download the Indiana State tax forms, go online: www.in.gov/dor (Department of Revenue).

Grant

Programs.

.

.

The Elkhart Urban Enterprise Association (EUEA) offers a Neighborhood Grant Program to neighborhood associations within the Elkhart Urban Enterprise Zone (EUEZ) to assist them with costs associated with neighborhood-sponsored projects and programs. The award amount will be based on the overall financial need of the project up to a $500 amount. Eligible grants include but are not limited to:

- Newsletter publications

- Neighborhood block parties and/or other events

- Clean-up and/or beautification activities (landscaping improvements, community gardens, etc.)

- Public art programs and beautification projects

Grants must be used in the year they are awarded. Any unused grant funds will not carry over into the next year. Grant payments are made directly to vendors upon receipt of invoices or reimbursement can be made to the neighborhood after receipts showing payment are presented.

Click here for the Neighborhood Grant application.

The Elkhart Urban Enterprise Association (EUEA) offers an Emergency Relief Fund to locally owned, small businesses within the Elkhart Urban Enterprise Zone (EUEZ) that have been economically impacted by COVID-19 related to loss of revenue. This is a grant and requires no repayment of the awarded funds. Eligible grants include but are not limited to:

- Rent

- Mortgage payments

- Utility payments

- Subscriptions

The deadline to apply is 5:00 p.m. Thursday, April 15, 2021.

Association

Scholarship.

.

.

The Elkhart Urban Enterprise Association (EUEA) offers an Enterprise Zone Scholarship as a part of its mission to improve the quality of life for Zone residents.

Applicants must live and/or work in the Elkhart Enterprise Zone and have received a high school diploma or equivalent (GED) prior to the start of the degree program chosen. The EUEA scholarship program is available to traditional and non-traditional students at an Indiana institution. Students of apprenticeship programs, vocational training programs, trade schools, technical schools, colleges and universities are eligible. Both part-time and full-time students are eligible.

Scholarship finalists will be required to attend a EUEA board meeting and make an informal presentation.

Eligibility

- Must live or work in the Elkhart Urban Enterprise Zone

- Must have a high school diploma or equivalent (GED) prior to the start of the fall semester

- Must be enrolled or accepted to an Indiana institution

- Be considered at least a part-time student by school or training program

- Must submit transcript after each semester

Requirements

- Submit the completed application

- Write a 500 word essay how the scholarship would help you achieve your educational/career goal(s)

- Provide Official School or Program Transcript

- If available, submit a resume

- Attend an EUEA Board meeting and make an informal presentation

- Provide proof of enrollment, tuition and book costs

- If already attending, have at least a 2.0 (C) Grade Point Average

- If you fall below a 2.0 Grade Point Average, no further funds will be awarded

Guidelines

- Scholarships are up to $1,000 per academic year, with a lifetime maximum cap of $4,000

- Scholarships are made payable to the school or training program

- All documentation must be submitted before an application will be considered

Application and all required materials due to the Elkhart Urban Enterprise Association

by May 7, 2021, at 5:00 pm

*The EUEA reserves the right to reject any and all applications

Zone

Map.

.

.

Find out if you live, work, or both in the Enterprise Zone!

Elkhart

Urban Enterprise Assoc.

.

574 294-5471 x 1027

.

About.

.

.

.

The Elkhart Urban Enterprise Association (EUEA) oversees the Elkhart Urban Enterprise Zone (EUEZ) and its programs that address the two-fold mission of the EUEA:

-

Increase the number of jobs in the EUEZ by the retention and expansion of existing businesses, and the attraction and development of new businesses.

-

Improve the quality of life of Zone residents, improve Zone residents’ employability and fill Zone jobs with Zone residents.

The Elkhart Urban Enterprise Zone (EUEZ) is an area of the community that is targeted for physical revitalization, job creation and improvements in social and economic conditions. The designated area includes downtown Elkhart and its nearby neighborhoods, as well as the residential and industrial areas located on the southwest portion of the community.

.

The EUEA Board & Officers

.

James Gardner, President

Therese Geise, Vice President

Bill Lavery, Treasurer

Kevin Bullard, City Council Representative

Arvis Dawson, Zone Resident Representative

Kristine Smole, Economic Development

.

Tax

Tax

Incentives.

.

.

The Elkhart Urban Enterprise Association (EUEA) oversees the Enterprise Zone, an area of the urban community targeted for physical revitalization, job creation, and improvements in social and economic conditions. In Elkhart, the Enterprise Zone includes the downtown and its surrounding neighborhoods, as well as its southwest residential and industrial areas.

Property Tax Investments

This refers to the increased value of an Enterprise Zone business property due to

real and/or personal property investment. The added valuation may be deducted for

up to 10 years. Qualified investments include: purchase of an existing building,

repair/rehab/modernization of an existing building, construction of a new building,

onsite infrastructure improvements, purchase of new manufacturing or production

equipment, or retooling of existing equipment.

Investment Cost Credit

Purchasers of ownership interest in a business located in the Zone may be

eligible for credit against their state tax liability. The allowable credit percentage —

of up to 30% — depends on the type of investment, the type of business and the

number of jobs created. This credit may be applied against individual or

corporate Adjusted Gross Income Tax liability. The Indiana Economic

Development Corporation determines the qualification and the credit percentage

allowed — prior to the purchase.

Employment Expense Credit

Enterprise Zone employers can earn tax credits for employing Zone residents. The

credit is the lesser of 10% of the increase in wages paid to qualified employees or

$1,500 multiplied by the number of those employees. The credit may be applied

against Individual or Adjusted Gross Income Tax, Financial Institutions Tax or

Insurance Premiums Tax liabilities.

Lenders associated with the Enterprise Zone may be eligible for loan interest credit. An individual or business that pays taxes in Indiana is entitled to a tax credit on interest income earned from a loan that directly benefits an Enterprise Zone business, increases Enterprise Zone property values or is used to rehab/repair/improve a Zone residence. The credit is equal to 5% of the loan interest received during the year. This credit may be applied against the individual or corporate Adjusted Gross Income Tax, Financial Institutions Tax or the Insurance Premiums Tax. Note: To receive those tax incentives, the lender need not to be located in the Enterprise Zone.

Residents who both live and work in Elkhart’s Enterprise Zone (EZ) may also benefit from potential tax-savings. They are qualified if they live in the EZ, they work at least 50% of the time within the EZ and at least 90% of their services as an EZ employee are directly related to the facility where they work within the EZ. If eligible, they may deduct half of their adjusted gross income earned during the year, up to a maximum deduction of $7,500. This could result in an annual tax savings for each resident of up to $255 if they are qualified and if their earnings within the EZ equal or exceed $15,000.

Indiana

Tax Forms.

.

.

Business

Property Tax Investment Deduction: Form EZ-2 (Indiana State Form 52501). To qualify for the Investment Cost Credit and prior to purchase of a property, a taxpayer must request the Indiana Economic Development Corporation determine whether a purchase of ownership in a business located in an Enterprise Zone is a qualified investment and the credit percentage to be allowed.

Employment Expense Credit : Schedule EZ 1, 2, 3 (Indiana State Form 49178)

Lenders

Loan Interest Credit: Schedule LIC (Indiana State Form 21926)

Employees

Enterprise Zone Qualified Employee Deduction: Schedule IT-40QEC (Indiana State Form 21928)

To learn more or to download the Indiana State tax forms, go online: www.in.gov/dor (Department of Revenue).

Grant

Program.

.

.

The Elkhart Urban Enterprise Association (EUEA) offers a Neighborhood Grant Program to neighborhood associations within the Elkhart Urban Enterprise Zone (EUEZ) to assist them with costs associated with neighborhood-sponsored projects and programs. The award amount will be based on the overall financial need of the project up to a $500 amount. Eligible grants include but are not limited to:

- Newsletter publications

- Neighborhood block parties and/or other events

- Clean-up and/or beautification activities (landscaping improvements, community gardens, etc.)

- Public art programs and beautification projects

Grants must be used in the year they are awarded. Any unused grant funds will not carry over into the next year. Grant payments are made directly to vendors upon receipt of invoices or reimbursement can be made to the neighborhood after receipts showing payment are presented.

Association

Scholarship.

.

.

The Elkhart Urban Enterprise Association (EUEA) offers an Enterprise Zone Scholarship as a part of its mission to improve the quality of life for Zone residents.

Applicants must live and/or work in the Elkhart Enterprise Zone and have received a high school diploma or equivalent (GED) prior to the start of the degree program chosen. The EUEA scholarship program is available to traditional and non-traditional students at an Indiana institution. Students of apprenticeship programs, vocational training programs, trade schools, technical schools, colleges and universities are eligible. Both part-time and full-time students are eligible.

Scholarship finalists will be required to attend a EUEA board meeting and make an informal presentation.

Eligibility

- Must live or work in the Elkhart Urban Enterprise Zone

- Must have a high school diploma or equivalent (GED) prior to the start of the fall semester

- Must be enrolled or accepted to an Indiana institution

- Be considered at least a part-time student by school or training program

- Must submit transcript after each semester

Requirements

- Submit the completed application

- Write a 500 word essay how the scholarship would help you achieve your educational/career goal(s)

- Provide Official School or Program Transcript

- If available, submit a resume

- Attend an EUEA Board meeting and make an informal presentation

- Provide proof of enrollment, tuition and book costs

- If already attending, have at least a 2.0 (C) Grade Point Average

- If you fall below a 2.0 Grade Point Average, no further funds will be awarded

Guidelines

- Scholarships are up to $1,000 per academic year, with a lifetime maximum cap of $4,000

- Scholarships are made payable to the school or training program

- All documentation must be submitted before an application will be considered

Application and all required materials due to the Elkhart Urban Enterprise Association

by May 1, 2020, at 5:00 pm

*The EUEA reserves the right to reject any and all applications

Zone

Map.

.

.

Find out if you live, work, or both in the Enterprise Zone!

River

District.

Elkhart’s Downtown Main Street has made major improvements in recent years, including sustaining more active restaurants, retail, art galleries, and market-rate housing available above downtown merchants. For such downtown development to be deemed successful, the market must respond by actively redeveloping the neighborhoods surrounding downtown Main Street.

River

District.

Elkhart’s Downtown Main Street has made major improvements in recent years, including sustaining more active restaurants, retail, art galleries, and market rate housing available above downtown merchants. For such downtown development to be deemed successful, the market must respond by actively redeveloping the neighborhoods surrounding a downtown Main Street.